We can gladly define instant loan apps as those apps that loan you money ($50) instantly without too many verifications and application submissions. They save you in case of emergency like when stranded and you need financial aid as soon as possible.

So we can call these apps a big-time savior when you needed them. Well, some of these apps come with an interest but not like loan shark apps that collect heavy interest within a short duration of time. If you come across such apps, please do not submit or collect money from them because they might be operating illegally and they may collect and sell your data to a third party.

That being said, in this post, we will be showing you the best instant loan app that you can collect at least $50 or less like $25 in just a few minutes. These instant apps give you a duration of 30 days to pay back and their interest rate is not on the high side.

$50 Loan Instant Apps for Instant Money

-

Chime

Chime is a fintech banking app that allows users to open a spending account with a minimum balance requirement. That is not all, they also give an instant loan to their users starting from $20 up to $200. This means you can borrow like $25, $40, $50, $100, and even up to $200 instantly without any hassle.

Upon opening an account with Chime, you can deposit instant $200 without any credit check. However, they will still use some methods to verify your application before approval. Chime also give customers a free card without fee charges for debit purchase.

2. PaydaySay

PaydaySay is another instant loan app that can give you a quick loan of $50. What the app does is to connect borrowers with lenders. This means you can either register on the app to be a lender or a borrower. You can collect loans from $100 up to $200. However, the loan collected is expected to be paid fully upon the expired date.

You need to pay the loan on time so that lenders can have their money back. But if you refuse to pay back, interest charges will be added to the loan. Unlike Chime, PayDaySay has a credit check before approval and since it’s an individual that will lend you the money, the interest is somehow high.

3. Brigit

Brigit is a loan app that you can link to your bank account. This app can give you loans ranging from $50 and $250. Since it links you to your bank account, it can only approve your amount based on your banking activity. After collecting a loan from Brigit, it automatically sets your advance repayment schedule.

The good news is that you can choose to pay back before the due date and you can choose to extend your loan duration period as well. This budgeting app has a $9.99 per month flat fee with zero interest and there is no credit check as well.

4. Earnin

Earnin is an instant loan app that can loan you up to $100 per day, and $500 per pay period with a $0 fee but has a transfer rate of $2.99. The interest rate is $0 while the waiting time for your loan to arrive is 1-3 business days. You can link Earnin to your bank account to be able to use the advanced features.

Now what Earnin does after linking it to your account is to automatically take back the advanced money when your Direct Deposit paycheck is due. You can choose to tip Earnin for the advance it gave you and you have to be employed to be able to use Earnin.

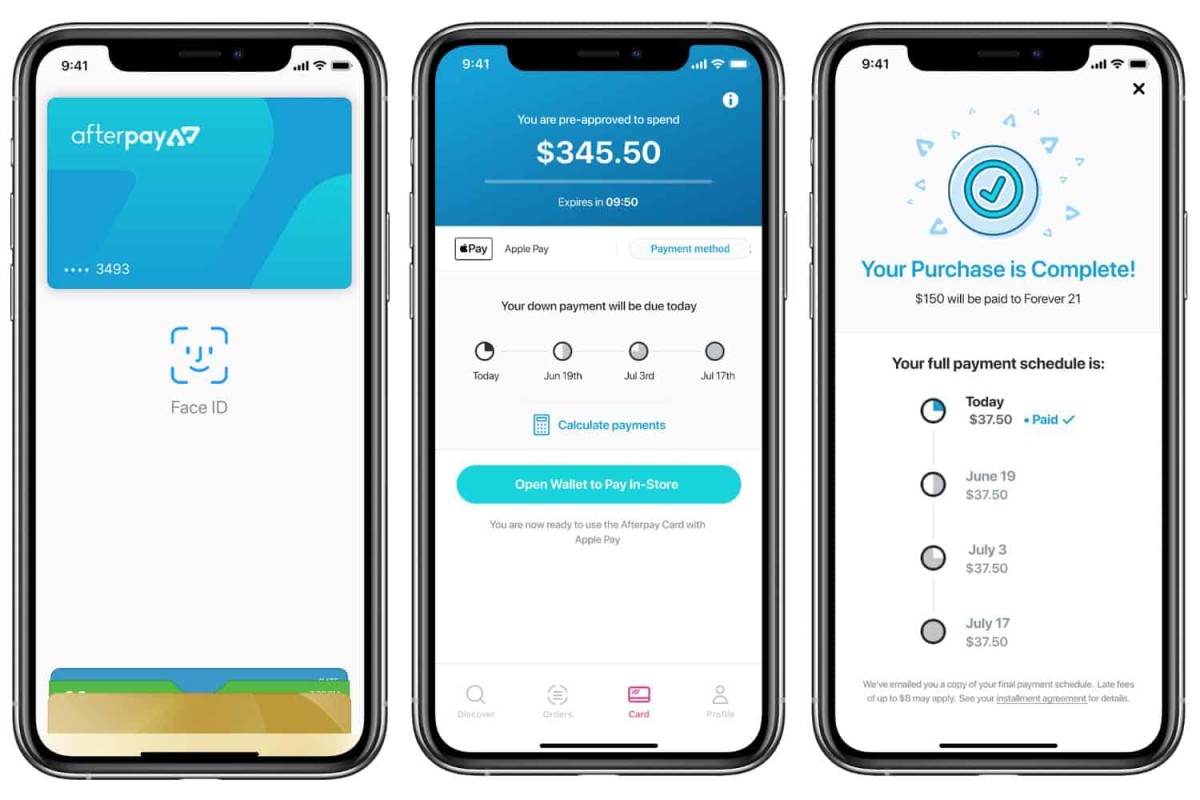

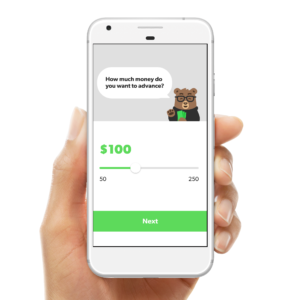

5. Dave

Dave is another instant loan app that can give registered members an instant loan of up to $250. However, the amount you get from Dave depends on many factors which include account history, your average balance, and your loan credit score.

You can also make a direct deposit to your Dave account so that the money you borrowed can be paid back in full once you reach your loan due date. You can pay the loan in installments or pay in full if you want. However, paying in installments should be before the loan due date.

Dave has a fee charge of $1 per month membership and it gives you a free in-network ATM usage and debit card usage.

6. MoneyLion

MoneyLion is a banking app that can give you an advance loan of $250 in cash via its Instacash feature. You can borrow the least $25 and up to $250. However, to qualify to use MoneyLion, you need to have an account that is at least two months old, show a regular deposit, and have an active account.

Instacash advances are paid back using a RoarMoney account or you can use an external checking account. The amount you will be eligible for will depends on your MoneyLion account history. The longer you have an account, the possibility of getting a higher advance loan.

Alternative To Instant Loan Apps

Instead of looking for an instant $50 loan app, why not go for the alternatives. These alternatives when follow will make sure you have $50 saved in your bank account anytime any day. You might be wondering what the alternative is. Well, here they are

Have an Emergency Fund

You must have been hearing people advise others to have or build an emergency fund. Well, it’s the best advice ever. Building an emergency fund will help you a lot in a time like this. We understand that many people may find this difficult. But come to think of it, if you can manage to save $10 per week, you will have up to $40 in a month which is close to the $50 instant loan you are looking for.

This means you will be able to save up to $80 in two months. This money can be your emergency fund. You can always make use of them in a similar situation and replace them afterward. What if you are jobless. No Job for now, what should you do?

Start A Side Hustle

While you wait for your dream job, starting a side hustle will help you to save and have enough money, not just $50, but enough cash that will save you in an emergency situation. We are living in a modern world where you can work with just your smartphone and internet connection.

There are many side hustle you can do which includes selling stuff online and looking for a gig on Fiver, Upwork, and many more. To make it easy for you, below are side hustles you can try.

- Teach English Online

- Sell items on Etsy

- Write an eBook

- Find (legit, trustworthy) gigs on Craigslist

- Sign up for TaskRabbit

- Deliver food for Instacart or DoorDash

- Drive for Uber or Lyft

- Get a job as a server for a restaurant that will let you start immediately

- Deliver pizzas

- Find gigs on Fiverr

- Babysit

- Teach Yoga

- Be a DJ

Conclusion:

A $50 instant loan app is a great way to relieve yourself of the financial burden, however, you should note that this comes with an interest rate. While some apps may not have an interest, they may come with monthly membership fees as well. Before downloading any app, make sure you read their term and condition, and please borrow what you can be able to pay back.

Leave a Reply