Cash App is a payment company and one of the most popular mobile applications in the United States. It was founded and launched by Square Inc., founded by Jack Dorsey, Twitter’s Co-founder. Cash App was released in January 2015, originally as “Square Cash” which lets users send up to $2,500/week via a linked debit card.

What does Cash App look like?

The app is very simple and provides an easy way to send money to friends and family members online or through your phone’s camera. You can deposit cash into the app wallet via debit card or bank account. When asking for payment from someone else, you can either enter their email address or just take a picture of the payment on a cash register or invoice.

The app is wonderful for checking balances, sending money to friends, paying bills, and even purchasing Bitcoin. You can also send money internationally through Cash App. It only takes about two days for the transaction to be completed so it’s an excellent way to move funds quickly without wasting time traveling to an office or bank branch.

Who is the CEO of Cash app?

Jack Dorsey is the CEO of Square Inc. Cash App and has been since its founding in 2009. Although it shares a name with the popular social media site, Cash App was not created by or affiliated with Twitter, which is also owned by Jack Dorsey. While it may be confusing to some users that both services were started by the same person, they are considered separate companies and should not be confused as such.

As an entrepreneur, Jack Dorsey started his first company in 2009, Square. Square was a mobile-payments company that provided credit-card transaction devices and software. It was created in 2010 and has over two million users by 2012.

As you can tell by this point in his career that Jack Dorsey has a knack for creating successful apps.

Cash App is operated by Square Inc., which is based in San Francisco, California. Jack Dorsey founded Square Inc., along with Jim McKelvey who serves as Chief Technology Officer of both Square Inc. and Cash App. Other notable staff members are Keith Rabois, former COO/VP Engagement & Strategy Cash App, Tom Kakuei, former VP Engineering & Engagement & now EVP Strategic Initiatives for Square Cash

How much is the cash app worth?

As of March 1, 2018, Square’s market capitalization was $31.6 billion. Cash App has been one of the primary drivers for this increase and is likely to contribute significantly to continued growth in valuation for Square Inc.

Since the last quarter, Square Cash App has seen an increase in both users and revenue. The app currently has 10 million monthly active users compared to 4 million users during the same period in 2017. Revenue for Q1 2018 was $71 million which is a significant 53% increase from Q1 2017’s revenue of about $47 million.

How do you buy things on Cash App?

It is a simple transaction by sending a dollar amount or a message to a family member or friend. You can also buy and sell Bitcoin on the app.

The majority of Cash App purchases are made electronically via debit cards, credit cards, and bank accounts. All you have to do is link your card with the app and make sure that it can handle recurring charges.

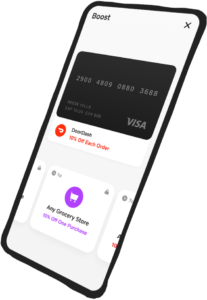

Cash App also offers the Cash Card, which is a prepaid debit card that can be loaded with funds from your wallet. The suggested amount for each load is $200 or less, but you can load as much money as your card will hold. You can withdraw cash at ATMs or retail locations that accept American Express cards. There are other requirements regarding the Cash Card, which you should read about online.

You can use these apps to buy items or services anywhere that accepts credit cards using your phone’s camera to take pictures of receipts for purchases. To send money to others, you just need their phone number or email address. They don’t even have to use Cash App.

What Bank is Cash App Funded by?

Cash App is not funded by a specific bank. It uses banks to transfer money between parties. The official bank of the Square payment app is Lincoln Savings Bank. It implies that the Lincoln Savings Bank stores maintain, and regulate all of the cash app’s money.

The Cash App requires that users set up their personal banking information with Cash App in order to facilitate payments between parties. Users are responsible for monitoring their bank accounts and reporting any fraudulent transactions or activity, which should be done immediately.

How Does Cash App Make Money?

The Cash App earns money by keeping an extremely small transaction fee in the 1% to 2% range. That’s much lower than what traditional banks charge for wire transfers and other transaction-related services.

Advertisers are allowed to use Cash App to promote products, services, or events on the app itself.

How To Get Money On Cash App – The Ultimate guide

Are you a fan of the cash app? If your answer is yes, then you must know about the app and its features. Cash app is an extremely useful and popular cash and debit card app that allows users to make payments directly from their mobile devices.

Because of its many benefits, many people have been using it as their cash and debit card app of choice. But have you ever wondered how to get money on the cash app? If you have, then you are in the right place. This article will guide you on how to get money on cash apps and other similar cash and debit card apps. Keep reading to discover the ins and outs of this popular app.

Cash App Download

If you have an iPhone or Android device, you can now use Cash App to easily manage your finances. With Cash App, you can:

- Pay for goods and services with ease

- Track your spending and investments

- Send money between friends and family

- View real-time bank balances

- Receive notifications about your transactions and bank balances

- Find nearby merchants that accept Cash App

Cash App is a new way to manage your money. This app does not store any private information like credit card numbers, debit card numbers, or PINs. We recommend you take a few minutes to learn how the app works.

Cash App is available for download in the App Store or Google Play Store.

How do I download Cash App?

To make it easier for you to download Cash App, we have provided instructions on downloading from the Apple and Android stores below:

Apple iPhone users: Go to the Apple store then hit the “Download” button on your phone’s browser. Follow the instructions on the screen and complete sign-up if needed.

Once downloaded, launch the app and sign in with your account details. You will see a confirmation screen that states you are ready to use Cash App! Just log in and start using it!

Android users: Go to Google Play store then hit the “Download” button on your phone’s browser. Follow the instructions on the screen and complete sign-up if needed.

Once downloaded, launch the app and sign in with your account details. You will see a confirmation screen that states you are ready to use Cash App! Just log in and start using it!

Cash App Login

To get started using Cash App, you must first create an account. There is no charge to create an account; however, you can only have one account per mobile device.

How to get Money on Cash App

Comparing the features and benefits of cash apps vs traditional banks is like comparing apples and oranges. The cash app has only one thing in common with the old-fashioned banking system – cash.

There is no account or balances associated with the cash app, only funds received and deposited directly into a user’s bank account. This is the #1 reason why the cash app has become so popular among consumers: it offers convenience.

Cash App may be used to send and receive money with anyone, even if they are in another country, using their phone number! When you transfer money outside of your nation, Cash App converts the money using the mid-market exchange rate at the moment the payment is made, and your receiver receives the money in their own currency.

Money Transfer: How to Send Money

To send a payment, follow these steps:

- Activate the Cash Ap

- Fill in the amount you’d like to send.

- Click pay

- Enter an email address, a phone number, or a Cash app hashtag (£Cashtag)

- Optionally, enter the purpose of the payment Tap Pay

- The funds will be reflected in your recipient’s account immediately.

Payments are subject to 3DS2, which will ask you to authenticate your identity before sending them. This will encourage you to double-check information or go directly to your bank’s website.

Check this page to learn about best practices and how to spot scammers.

How to Get Money: Receive Money on Cashapp

You may also use the Cash App to make a money request. To do so, follow these steps:

- Activate the Cash App

- Enter the amount you’d like to request in the box below.

- Click Request

- Enter an email address, a phone number, or a Cash app hashtag (£Cashtag)

- Enter a reason for asking for donations if you want to.

- Click Request

When you make a money request, the person you’re requesting money from has 14 days to accept or deny it. The request will automatically expire if they do not answer within 14 days.

Limits on sending and receiving

When you first start using Cash App, you’ll be able to:

- Send up to £250 per 7 consecutive days

- Receive up to £500 for seven days in a row.

- Maintain a total stored balance of £500.

To keep Cash App safe, if you transfer or receive more than the limit, you will be asked to validate your account with your complete name, date of birth, and address.

After your account has been validated, you’ll be able to:

- Send up to £1,500 over a seven-day period.

- Receive up to £10,000 for seven days in a row.

- Maintain a total stored balance of £10,000

You will be required to verify details within the app before sending or receiving a cross-border payment.

After your account has been confirmed, you’ll be able to:

- Send up to £1,000 over a seven-day period.

- Receive up to £1,000 for seven days in a row.

Cash App direct deposit

One of the unique things about the cash app is that users can make direct deposits online directly into their bank accounts. These funds can be deposited into a user’s account in one of two ways: A. User initiates the payment themselves B. Invites the employer to initiate the payment into their account.

For example, let’s say a customer makes a $500 cash payment on their cash app. The cash app sends the funds directly to the customer’s bank account. This is the easiest way to cash out your cash app balance. However, some banks will also allow you to send money to your account via a third-party payment provider like Western Union or MoneyGram.

How to make Money on Cash App

The following are some simple ways to make free money on Cash App:

1. Cash App referral bonus: When you refer someone to the cash app, you will get a $5 bonus on each transaction made.

2. Get free money with Cash App: You can get free money when you make a referral.

3. Earn $5 When You Sign Up: You can get $5 when you sign up.

4. Cash Card Boosts: You can get cash card boosts depending on your app activity, which can be redeemed to get more money or buy gift cards.

5. Bitcoin Boost: You can also gain free money on Cash App Bitcoin Boost if you use your Cash App debit card to make qualified transactions. The money you make comes in the form of bitcoin, which you may sell for cash.

Cash App For Business

The cash app for business is a quickly growing trend that provides businesses with an easy way to accept and process payments. The app allows businesses to accept payments by either bank transfer, debit card, or credit card.

This convenient option makes it easier for businesses to run their transactions and helps them reduce the time it takes to process payments. Additionally, the cash app for business offers more features than traditional payment apps such as Apple Pay.

For example, the cash app for businesses includes tools that help businesses manage their finances including invoicing, tracking expenses, forecasting sales growths/declines, and managing inventory.

Merchants with a Cash App business account may use the app to make sales while staying within the terms of service and the law. The following are the qualities of a Cash App business account:

- Special payment URLs and QR codes can be utilized for transactions.

- Allows you to receive payments using a peer-to-peer (P2P) system.

- There are no restrictions on the amount of money you can get.

- Allows you to take credit cards from the Visa, Mastercard, American Express, and Discover networks.

Business Fees

Cash App for business includes transaction costs in addition to the optional fees personal accounts pay for expedited bank deposits, which may be upsetting if you’re used to peer-to-peer transaction applications being free.

- Fees for Cash App business accounts are as follows:

- Per transaction, 2.75 percent

- On instant deposits, there is a 1.25 percent charge (minimum $0.25).

How To Create A Business Account On Cash App

It’s simple to open a Cash App business account:

- Download Cash App

- Create a personal account.

- Tap the symbol that looks like a human in the upper right corner of the app. Your account details will be shown as a result of this action.

- “Personal” should be the top submenu. That should be tapped. Your personal information can be found there. You should see the option to Change Account Type if you scroll all the way to the bottom. Click Change account type.

- Select Change This Account from the drop-down menu.

- Accept the confirmed response.

- You should link a bank account to your Cash App if you haven’t previously. Select Linked Banks from the drop-down menu and follow the on-screen instructions.

It’s worth noting that you can verify your account before or after converting it from a personal to a business account.

You’ll be requested to verify your account the first time you try to exceed the restrictions of an unverified account. After that, you’ll be prompted to provide personal information such as your complete name and Social Security number.

You may use your $cashtag to create a payment link that you can text, email, message, or embed on your website. They will be sent to a “Cash.me” website where they may log into their Cash App or input their name, email address, and credit or debit card information.

Why You Should Use Cash App For Business?

Cash App is a fantastic convenience for organizations that make occasional and modest transactions. You’ll be able to accept Cash App and credit card transactions with no effort and no additional gear beyond your current mobile device.

You can also link your business account to a PayPal account and accept PayPal payments.

Cash App is ideal for small businesses that want to accept credit cards, including those that don’t have a merchant account with a bank or credit card processor.

Cash App has the same features as Venmo, the popular peer-to-peer payment service. It’s easy to use and has low fees. You can also link your Cash App bank account to Venmo so you can easily convert any of your deposits into Venmo payments.

And unlike other services like PayPal, you won’t be limited by their caps on monthly transactions or fees for every transaction.

Who owns Square?

Two seasoned entrepreneurs, Twitter Inc. (TWTR) co-founder Jack Dorsey and Jim McKelvey, started Square in 2009. It started as a small company in the back of Dorsey’s San Francisco. The company has grown to be one of the most popular payment processors for small businesses and individuals. Square is valued at $17.66 billion and it has more than 10 million active customers.

How to receive money on the cash app for the first time?

- Download Cash App

- Activate your account

- Enter the amount you’d like to request in the box below.

- Click Request

- Enter an email address, a phone number, or Cash app hashtag (£Cashtag)

- Enter a reason for asking for donations if you want to.

- Click Request

When you make a money request, the person you’re requesting money from has 14 days to accept or deny it. The request will automatically expire if they do not answer within 14 days.

Why can’t I receive money on the cash app?

There are a few things that could be going on in your app and wallet. Unfortunately, something went wrong and you may not be able to receive money from the Cash App yet. Try again later or contact our customer service at 1-800-969-1940 for more help.

If you are having issues with Cash App, we recommend you first try the following:

– Clear your app’s cache and data.

– Try again later.

– Contact customer service at 1-800-969-1940 for help.

Will Cash App refund money if scammed?

Yes, Cash App keeps an eye on your account for anything out of the usual. Cash App will cancel any potentially fraudulent payments to avoid you from getting charged.

Your cash will be refunded to your Cash App balance or associated bank account immediately if this occurs. If not, depending on your bank, they should be accessible within 1–3 business days.

Is it safe to Cash App a stranger?

Yes, because the cash app only stores the user’s public data and they only share that data with the person they are making a transaction with. So, if you are making a cash app payment to a complete stranger, you are actually sending them money.

Can you reverse Cash App payment?

No, Cash App cannot be reversed. Cash App payments are made in real-time and cannot typically be reversed. Check your activity stream to verify whether the payment receipt has a cancel option to be sure. Your payment may potentially be refunded by the receiver. Ask them to refund your payment.

Cash App Bank Statement

A cash app bank statement is a digital document that shows how much money you have in your account and the transactions that have taken place. This document can be helpful for checking your account, verifying funds are available, and confirming debts.

You may get your account statements by:

- Go to https://cash.app and sign in.

- In the top-right corner, click the Statements button.

- You may choose whatever monthly statement you wish to look at.

- Monthly statements will be accessible 5 business days after the end of the month.

Cash App customer service hours

Please contact Cash App Support via your Cash App or Cash App phone line to talk with a professional (1-800-969-1940).

Is the Cash App Safe?

Cash App is an extremely secure app. You are required to create a PIN number before you can make any transactions with the app. The only people who can send money using your account are yourself and anyone else with that you share your PIN.

Each payment made through the Cash App is protected by 128-bit SSL encryption which prevents unauthorized parties from viewing sensitive information between devices or servers. Your funds are limited to the amount of money that you have available, and each transaction is deleted as soon as it is sent.

Cash App also has a variety of optional security features such as TouchID or FaceID for those who want to enable biometric login security access to their accounts. It can be set up to require passcodes for specific actions like transfers and checking your balance.

Users can restrict logins by IP address and even make Cash App transactions anonymous which hides how much funds they receive or spend from other users. They also offer two-step verification login codes via text messaging if you lose your phone or suspect someone else might be using it without your knowledge.

Final Thoughts

Cash App is definitely an innovative new peer-to-peer payment app for iPhone and Android phones. It has its flaws, but it works well enough to be worth checking out if you’re the kind of person that needs instant access to their money at all times. It is useful if you want an easy way to send cash quickly without having to make a trip to the bank or wait on snail mail checks.

Cash app is a popular cash and debit card app with plenty of benefits. It is easy to use, safe and reliable, and made especially for consumers who want to pay quickly and easily. It is not only great as a cash card but can also be used as a travel card, business card, and more.

Comments (2)