Hello, if you wish to verify your tax registration number you can now do that easily on your mobile phone but before then, let’s brush what TRN is all about.

MEANING OF TRN AND VERIFICATION IN UAE

The TRN which stands for Tax Registration Number is a unique number assigned to every VAT-registered person or business in the UAE for identification. It’s imperative that this number is included in all VAT invoices by registered businesses on their supplies.

A person or organization in UAE can check the validity of TRN using the available FTA portal. It’s simple and you can check it on your phone or any electronic that has access to the internet.

The TRAN is important because it helps you to know of the business or an individual rendering a service to you is registered in the UAE. Even consumers can check the TRN validity of a dealer/retailer to ensure that they are eligible to charge VAT on supply and to also stay away from fake TRN.

HOW TO VERIFY TRN IN UAE

Though earlier it was a necessity for you to register on FTA website before you can verify your tax. But now anybody can choose to register or not and still verify your TRN number.

In this article, we will show you the simple steps to verify your TRN number in without any prior problem. Just follow the steps below to do that and don’t forget to ask any questions in case you find it difficult doing that.

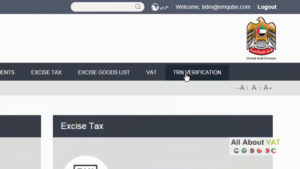

- Visit official website page for Tax Registration Number

- On the open page, you will see the specs for TRN verification.

- Enter your TRN number (number of your supplier/service provider as provided on tax invoice)

- Enter the security code on the spec provided.

- Click Validate

Now if the TRN number provided by the supplier or service provider it will provide the corresponding name in English and Arabic with the respective tax registration number issued in UAE by the FTA (Federal Tax Authority)

If the TRN provided is correct and validated this will simplify the correct filing of VAT returns and settlement of payable tax within the time stipulated by FTA UAE.

If you encounter any problem with the verification, scroll down on the page and use the contact information below the page to get help from the authority. Good luck.

Leave a Reply