If you are in need of extra money, you should review the terms of each lending option you consider taking out. Predatory lending is common today, so it’s your duty to know your rights and do everything you can to protect yourself from sky-high fees and abusive credit.

Predatory creditors usually have aggressive tactics trying to persuade you to accept their terms and make you request the loans you can’t afford. Here is what predatory lending is and ways to avoid it.

What Is Predatory Lending

This term refers to the deceptive, abusive, or unfair lending terms for consumers. According to the predatory lending definition, such lending conditions may include sky-high fees and hidden charges.

They may also place a consumer with good credit in a lower credit-rated loan, strip the client of equity, or approve the request with expensive finance charges. All of these features make this lending type beneficial only to the crediting company.

Such lenders usually utilize aggressive sales methods and benefit from the clients’ lack of understanding of their rights and financial operations. Using fraudulent and deceptive actions without honest information, predatory creditors induce and entice an applicant to obtain a loan at their company that they will most likely not be able to repay.

Recommendations to Protect from Predatory Lending

What can states do to protect borrowers from high-cost lending options? They should:

- Place caps on interest rates for various lending options. Interest rate caps may be not effective in case creditors evade them through high rates.

- Examine consumer lending bills thoroughly. They should review all the interest rates and hidden fees that might apply. Calculate the total cost of borrowing together with the interest, the full APR, other finance charges, and fees.

- Ban loan fees or limit them.

- Adopt a tiered rate with loan caps below 36% for big sums. Smaller loans can have a maximum APR of 36% if a borrower obtains up to $1,000, while larger sums should consider a lower interest.

- Prohibit the sale of add-on products and credit insurance as it only benefits the crediting company and the cost of credit increases.

- Require creditors to evaluate the client’s ability to pay the debt off to avoid predatory lending examples.

- Limit balloon payments, excessively long loan conditions, and interest-only payments.

Tactics of Predatory Lending

While certified crediting institutions and Fit My Money legit companies offer fair lending, predatory creditors only want to make more money on you. Such creditors don’t review if the borrower has enough means to pay the debt back. Predatory lending tactics take advantage of a person’s lack of understanding of the rules and terms. These methods include:

Balloon Payment

It is a large payment that is required to pay at the end of the loan term. Predatory creditors often make the monthly loan payment seen lower but then demand a balloon payment. If you weren’t prepared to deal with this payment and cover it, you may face default or more costs to refinance the debt.

Excessive Charges

Such abusive fees aren’t mentioned in the interest rate. Some lenders claim fees of more than 5% of the total sum and don’t include it in the interest.

Asset-Based Lending

When you request a secured loan, the creditor will issue the funds based on your valuable asset. It can be your car or house but not your ability to pay the debt off. Thus, many borrowers face an issue with debt repayment and fall behind on payments. If you don’t repay the loan on time, your asset can be seized by the lender.

Loan Flipping

The crediting company makes a person refinance, again and again, increasing rates and the total cost of credit. It leads the borrower to an endless debt cycle.

Steering

Creditors steer clients into expensive loans when they may qualify for prime lending conditions.

Add-On Services And Products

Such unnecessary products as single-premium life insurance for a mortgage can be forced to buy.

Generally, predatory lending works to offer abusive practices carried out by certain institutions to induce and entice borrowers toward accepting loans that can’t afford to pay off.

As a result, consumers face risks of default and have to pay sky-high fees and additional interest or they will end up in a vicious debt cycle. The lack of knowledge and understanding is beneficial to these lenders.

One of the examples of this lending is a loan shark. It is someone who lends you cash at a very expensive interest and might use abusive tactics to threaten you in the future. Even companies, banks, and mortgage brokers may be predatory so it’s important to determine the red flags and avoid such predators.

Lending Statistics

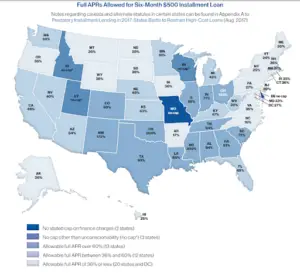

According to the 2020 report on predatory installment lending in the USA by the National Consumer Law Center, the primary vehicle by which states protect borrowers from predatory lending are caps on interest rates and charges. However, these caps face risks.

In-state after state, creditors that offer high-cost lending are mounting campaigns to convince policymakers to weaken or disregard these regulations. Over the last five years, Colorado, California, Ohio, and New Mexico improved their laws, reducing APR caps. Oklahoma and Iowa, on the other hand, increased the APRs allowed for installment loans.

The Bottom Line

In conclusion, it’s essential to educate yourself on various types of predatory loans, know how this lending type works and what you should watch out for before you sign any contracts. Don’t sign any papers if you don’t fully understand the conditions of debt repayment. Understanding the financial regulations and lending rules will help you avoid predatory lending and opt for secure and legal solutions to fund your immediate cash needs.

Leave a Reply