Household income is the total net income of all members of a certain household above a certain age restriction. Individuals in question do not have to be connected in any manner to be considered members of the same household. Household income is an important risk indicator for lenders who use it to underwrite loans, as well as an economic indicator of an area’s level of life.

Median household income is a commonly reported economic statistic. Because many homes consist of a single person, median household income may be lower than median family income because a one-person household is not taken into account when determining average family income.

Looking at household income figures may help you compare the wealth and living standards of various cities, states, or nations. Household income is adjusted gross income at the personal level, which means it is the money left over after taxes.

Understanding Household Income

Household income is commonly defined as the total gross income before taxes obtained by all members of a household above a given age over a 12-month period (the Census Bureau specifies age 15 and older).

Wage, salary, and self-employment earnings; Social Security, pension, and other retirement income; investment income; welfare payments; and income from other sources are all included, excluding debts, pledges, and payday loans no faxing – only profits are taken into account.

Depending on the situation, the definition of family income and its components vary. The phrase might be established by legislation or regulation, or it can be decided by researchers or writers as a sum that includes or excludes certain revenue items. Here are a few such examples:

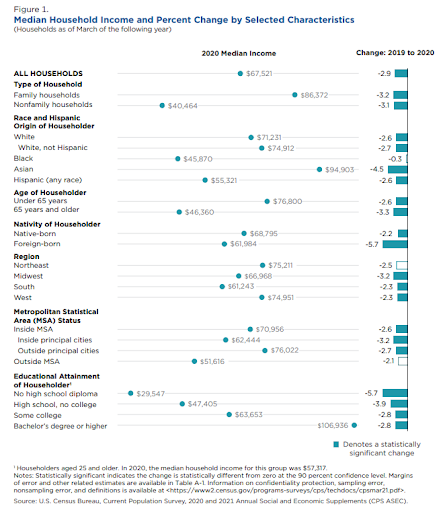

- The U.S. Census Bureau counts all pre-tax cash income of all persons age 15 and older who are members of a household, regardless of whether they are related to one another, in determining household income. According to the Census Bureau, the median household income in the United States in 2020 will be $67,521.

- In certain programs and studies, the value of non-cash benefits or receipts, such as food stamps, is included in the calculation of family income. For example, the Congressional Budget Office (CBO) estimates total income by adding non-cash income, primarily in-kind government benefits and services, to cash income.

- Household membership may vary in various circumstances, such as different government programs and a broad variety of economic surveys and research, or the analysis may concentrate on people. According to HealthCare.gov, the definition of household income in determining who gets a subsidy to help pay for health insurance through the Affordable Care Act (ACA) includes “yourself, your spouse if you’re married, plus everyone you’ll claim as a tax dependent, including those who don’t need coverage.”

In addition, family income is measured by subtracting specified costs or allowances from gross income for evaluating eligibility for several public benefit programs.

What role does household income play as an indicator?

This metric is also one of the three most often stated criteria of individual wealth. The other two, family income and per-capita income, measure how well individuals in a specific region are doing financially in somewhat different ways.

Household income takes into account the earnings of all persons above a certain age who live in the same housing unit, regardless of relationship. A household may also be a single individual who lives alone in a home.

Family income, on the other hand, only includes homes inhabited by two or more persons who are related to each other by birth, marriage, or adoption. Per-capita income is the average income received by each individual in a specific location. When calculating per-capita income, two income earners in the same family or household will be included individually.

Economists utilize the household income to draw inferences about the economic health of a certain region. Comparing median household earnings across nations may help us determine where residents have the best quality of life.

Household Income Example

Dave’s annual salary as a financial specialist is $120,000. Alex, his wife, makes $80,000 as an analyst. Their family’s combined income is $200,000. Jim, Dave’s nephew, also lives with them. Jim’s compensation at work is $40,000 per year. If these people’s wages are their only source of income, their total household income, as defined by the Census Bureau, is $240,000.

Median Household Income vs. Average Household Income

The number of households utilized to calculate median and average household income may vary. The Census Bureau includes households with no income in their computation of median household income in the United States. Other income studies, notably those concentrating on different average income data, employ solely positive income figures.

When the median and average amounts of household income for all U.S. households are computed, the average figure always exceeds the median due to the influence of the tiny number of U.S. homes with extraordinarily high earnings.

The Distinction Between Household Income, Family Income, and Per Capita Income

One of the three most widely used metrics of individual wealth is household income. The other two, family income and per capita income, measure how good individuals in a specific region are doing financially in various ways.

The U.S. Census Bureau defines household income as the gross cash income of all person ages 15 and older who live in the same dwelling unit, regardless of how they are related, if at all. A household also includes a single individual who lives alone in a residence.

Only homes inhabited by two or more persons related by birth, marriage, or adoption are included for family income.

Per capita income is the amount of money made by each person in a certain location. When calculating per capita income, two-income earners in the same family or household are considered individually.

Bottom Line: What Is Median Household Income in April 2022?

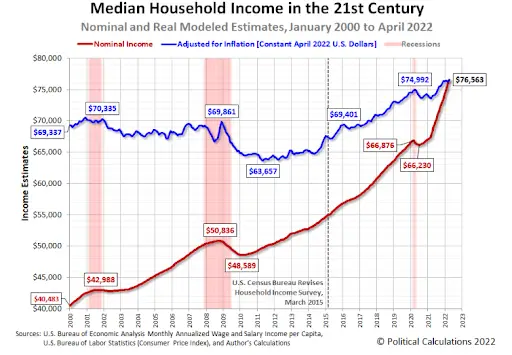

Now that you understand what household income is, let’s move on to actual statistics to round out the picture. Political Calculations’ first estimate of median household income in April 2022 is $76,563, up $1,024 (or 1.36 percent) over the March 2022 projection of $75,539.

The most recent update to Political Calculations’ graphic monitoring Median Family Income in the Twenty-First Century shows the nominal (red) and inflation-adjusted (blue) trends in median household income in the United States from January 2000 to April 2022. The values have been adjusted for inflation and are provided in constant April 2022 US dollars.

In April 2022, the rate of inflation declined from prior months. In constant April 2022 U.S. dollars, median family income increased by $299 from the revised estimate of $76,264 in March 2022. Inflation erased over 71% of American families nominal month-over-month increase.

Leave a Reply